This afternoon the US equity market reacted to a rumor that there was a deal finally to end the shutdown when this was announced:

But wait, one might say, the rally started around 1 pm but Schumer did not start speaking until after 2:30 pm ET. How did the rally start earlier?

Do any of my readers really believe that insiders were not tipped off that this “might” be the deal to provide relief and that the political animals plus Wall Street insiders didn’t try to initiate a short squeeze at the 50 day moving average so markets would bounce up?

Hell no. I’m not that naive and my readers shouldn’t be either. So how does this look on the big chart with a relative low volume intraday sort of dead cat bounce:

Until we see a substantial violation of the 50 day moving average and then a sharp move towards the 200 day moving average, this uptrend, albeit weakened, continues. But what makes today’s market action unique? Let’s look at the most actives volume today on the NASDAQ, aka, the speculator or gambler’s market:

While the numbers look impressive, keep in mind that these pages and many others have been providing coverage of retail boosting the volumes of some penny stocks to 200, 300, and even over 700 million shares traded on a daily basis. So was today a vacation day or is this the start of of a paradigm shift in the markets?

Perhaps today’s trading session lends some credence that for once, the retail bagholders were not going to suckered again as the story from Axios should cause for panic for Wall Street insiders looking to dump their garbage positions on ma, pa, and their stupid kid’s portfolios:

Main Street investors are “skipping the dip”

From the article:

Why it matters: Retail makes up a quarter of stock trading volume. If these investors stop buying dips, that could make selloffs longer and larger.

What they’re saying: Retail is “skipping the dip,” according to a note from JPMorgan analyzing trading activity from novice investors.

-Not only did these investors scale back ETF purchases, they also turned net sellers in single stocks, though it was driven in part by profit-taking off the back of Palantir’s earnings, the analysts note. The Magnificant 7 still accounted for the entirety of single-stock buying by retail investors.

- Not only did these investors scale back ETF purchases, they also turned net sellers in single stocks, though it was driven in part by profit-taking off the back of Palantir’s earnings, the analysts note. The Magnificant 7 still accounted for the entirety of single-stock buying by retail investors.

State of play: Wall Street institutions have been forced to stay invested because of retail investors in some instances.

-Several money managers tell Axios they are hoping for a pullback in the market to get back in, after having failed to do so when retail investors successfully took advantage of the “Liberation Day” selloff in April.

As the classic equity investor Scooby-Doo might say “Ruh-Roh.”

So if retail exhaustion has set in, where does that leave the institutions and especially the speculative hedge funds?

Forced liquidations as liquidity creates a drying up and threat to their credit holdings for which retail nor the government are prepared for.

To provide some context as to why these pages observes this parallel, an ominous parallel at that, here is a chart from the 4th quarter S&P 500 in 2007:

If this is the start of the market rally which happened on November 13, 2007 with a dead cat bonce, markets should roll over again next week barring a major political or economic development and continue to decline into Thanksgiving.

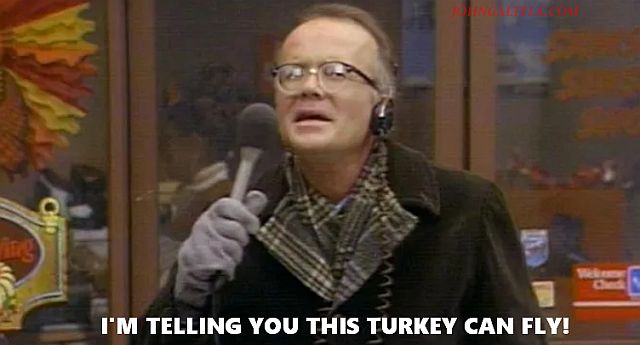

Buckle up America, this Turkey’s got wings and according to some broadcasters, perhaps those on major financial television, they will try to see if this bird can still fly.