It’s that time of year again ladies and gents.

The big question is when are the banks and more credit unions going to join the party?

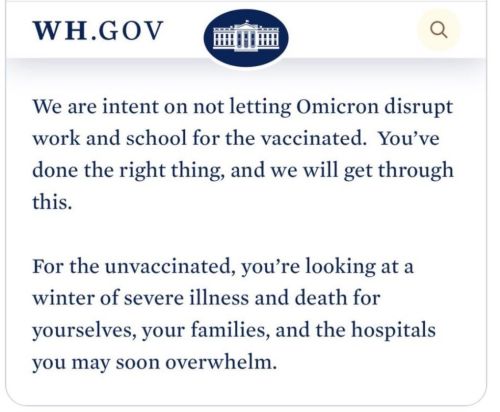

All of the signs are there:

- Credit card delinquencies rising

- Subprime auto loans falling into default and delinquency

- Subprime mortgages creeping into 60+ days delinquent

- Layoffs and reduced hours increasing

Thus when these institutional failures begin to hit “suddenly” do not be surprised.

From the National Credit Union Administration website:

1st Choice Credit Union Conserved

Accounts Remain Protected by Share Insurance Fund; Member Services Uninterrupted

ALEXANDRIA, Va. (June 14, 2024) – The National Credit Union Administration today placed 1st Choice Credit Union in Atlanta, Georgia, into conservatorship. This action was taken in consultation with the Georgia Department of Banking and Finance.

Member deposits at 1st Choice Credit Union remain protected by the National Credit Union Share Insurance Fund. Administered by the NCUA, the Share Insurance Fund insures individual accounts at 1st Choice Credit Union up to $250,000, and a member’s interest in all joint accounts combined is insured up to $250,000. The Share Insurance Fund also separately protects IRA and KEOGH retirement accounts up to $250,000. The Share Insurance Fund has the backing of the full faith and credit of the United States.

Member services will continue uninterrupted at both of the credit union’s branches in Atlanta. Members can continue to conduct normal financial transactions, deposit and access funds, make loan payments, and use shares. The offices are open Monday through Friday from 8:30 a.m. to 4:00 p.m. Eastern time.

Members with questions about 1st Choice Credit Union’s operations may contact the credit union at 404-832-5800. Members with questions about the conservatorship may review the 1st Choice Credit Union frequently asked questions posted on the NCUA’s website. Members with questions about their Share Insurance Fund coverage can find more information in the Share Insurance Coverage (Opens new window)section of NCUA’s MyCreditUnion.gov (Opens new window)consumer website.

1st Choice Credit Union is a federally insured, state-chartered credit union with 6,709 members and assets of approximately $38.6 million, according to the credit union’s most recent Call Report. 1st Choice Credit Union serves employees of Grady Hospital, Morehouse School of Medicine faculty, Emory University School of Medicine faculty, Southside Healthcare, Atlanta Life Insurance Company, South Fulton Community Development Corporation, credit union staff, and family members.

Buckle up folks, it’s just the second inning and this could become a very ugly ball game.