“Revenge is a dish, best served cold”

-Khan, Star Trek II

Right about now, President “The Don” Trump is feeling a chill in the air while visiting jolly old England and watching the moves made by the Federal Reserve actions out of the corner of his eye.

And in true form, the FOMC meeting concluded with exactly what I said it would last night:

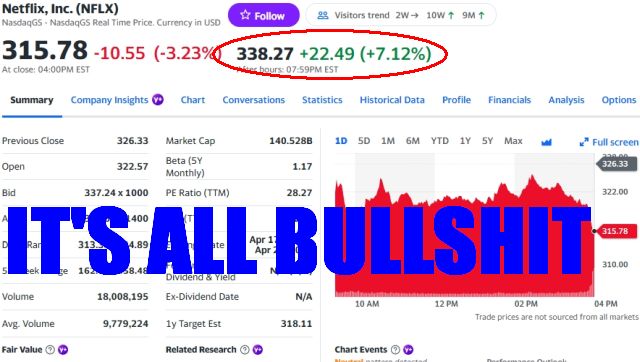

And no one except for a few lucky call holders on some select Dow stocks is happy tonight. Precious metals sold off hard then rebounded, sold off again, and rebounded. All of the major equity indices soared higher and then of course Fed Chair Powell went Full Metal Gobblygook trying to sound like a Greenspan or a Bernanke but instead sounding like a college professor at a beer chugging frat party, guessing instead of addressing the problems facing the US economy.

Need a hint as to why?

The FOMC Statement Today

From the Federal Reserve website:

Recent indicators suggest that growth of economic activity moderated in the first half of the year. Job gains have slowed, and the unemployment rate has edged up but remains low. Inflation has moved up and remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook remains elevated. The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen.

In support of its goals and in light of the shift in the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 4 to 4‑1/4 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

I have added emphasis to key parts for historical comparisons. From the first paragraph we see the statement “that growth of economic activity moderated in the first half of the year.” I present to my readers, the start of the second sentence from the FOMC Statement of September 18, 2007:

“Economic growth was moderate during the first half of the year,”

Weird, isn’t it.

Although the 2007 statement did not mention targeting the employment picture, the idea about inflation was a central theme also:

“Readings on core inflation have improved modestly this year. However, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.”

Meanwhile the classic sentence “Uncertainty about the economic outlook remains elevated” sounded like this in 2007:

“Developments in financial markets since the Committee’s last regular meeting have increased the uncertainty surrounding the economic outlook.“

I need a job there where I can copy and paste all day long.

The twist on the final sentence from today’s statement of “The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments” sounded like this in 2007:

“The Committee will continue to assess the effects of these and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.“

This is just some food for thought as we review other things that seem to sound familiar but are not quite paralleling 2007 as we don’t have the banking crisis to go along with a slowing economy.

The 10 Year Bond Responds

The initial move was to rally the US 10 year today and then of course sell it off. But let’s go back to that fateful meeting on September 18, 2007 and see what the US 10 year yield did after the FOMC meeting.

Interesting, but compared to the Effective Federal Funds Rate per last night’s discussion?

In 2007 the bond market sent the warning signs be it the 2 year or 10 year Treasury and the FOMC was just along for the ride.

Does history repeat?

Today’s 10 year yield reaction performed almost identically with a leap higher in yield after the statement:

Just like 2007, the 10 year is still moving with a wide spread versus the EFFR. The question now is will the spread narrow with the Treasury selling off before rolling over again as more economic weakness is recognized by the bond market.

There is no point rehashing the US 2 year yield as it barely moved up just 3 bps.

Gold and the US Dollar

While everyone was focused on Jay Powell’s Mysterious Nonsensical Word Salad Tour, aka the press conference, the markets went wild. Gold was down before the statement, rallied into the press conference, dropped again sharply, then rallied into the Wall Street close.

The US dollar behaved in a similar fashion until Mr. Powell began to speak then it was smart and wise to dump dollars and buy anything else to avoid holding the Greenback.

Until we see a definitive move by the bond market resuming a lower for longer yield move to reflect the underlying weakness in the economy, long select commodities like gold and short the US dollar seems to be the smart play.

The Wrath of Don

Much like the great movie from my era as a youth, there is a wrath coming home on Air Force One in a day or two like a Klingon Battle Cruiser crossing the neutral zone. Once the President can escape the formalities, look for him to blast the FOMC and especially Jay Powell on Truth Social, perhaps even in the wee hours of the morning.

By refusing to support Miran’s call for a 50 bps cut, Fed Governor Waller has pretty much removed his name for consideration as the Chairman along with any other member that voted for the 25 bps reduction. What will make this “too late” rant epic is not only the fury he will direct at the US Court of Appeals for not removing Lisa Cook, but also Powell for failing to recognize the trouble the real estate industry is falling into.

The FOMC voted to continue Quantitative Tightening at the current scale which means there is little incentive for banks to relent on lending standards much less loosen the flow of credit to the sub 650 FICO borrowers. This means even fewer buyers for all the homes that hit the market and yes, even automobiles as reports indicate the increase in delinquencies recently.

For the officers and employees of the Eccles Building they should be quite thankful Air Force One is not equipped with Klingon disruptors because someone is going to be heading home with a full angry orange hot head of steam, ready to unleash the Wrath of Don.