If one is an intelligent, rational, sane individual, one would be deeply concerned if not privately freaking out.

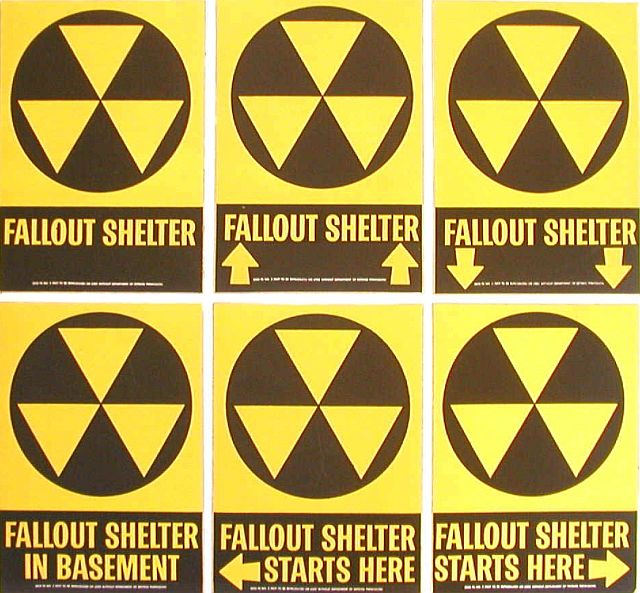

Now these pages are not calling for the beginning of World War III, yet, nor the need to dig a bomb shelter (what you don’t have one?), there is a legitimate reason to be deeply concerned about the message precious metals, especially gold, is sending.

Today’s market action speaks volumes as to why this author is concerned.

The media trots out many of the usual tried and true stories about how gold is a hedge against inflation and that the US dollar is still strong, etc., etc. The reality is that finally, versus the past, the price of gold in US dollars is catching up to the global devaluation of fiat currencies as documented many times in the past.

But there’s a darker truth that one must put in the forefront when evaluating this years move in gold as highlighted in the chart below (as of today’s close):

The world’s central banks are desperately learning the hard lesson Russia tried to teach them:

Diversify out of the US dollar or face the weaponization of the global reserve currency against ones economy.

The next move in the gold market should be a continuation move into a blow-off top, possibly as high as 4200 to 4300. Then the correction these pages wrote about will probably occur as margin calls and panic in global equity markets forces hedge funds, private equity firms, and some governments to get liquid quick and sell their gold to raise cash to service debt.

Any breakout above $4500 per ounce can be viewed as a major warning that something worse, something much larger geopolitically, is on the horizon.

The scary part about the history empires of using their currency as a weapon?

Trade wars usually lead to shooting wars; but why should the idiots in charge start paying attention to history now.

"now what"

Now it goes higher. I didn't think we'd see 4000 till at least the end of the year, but it may well break through 4500 even before that.

So what if retail is bailing in. This plane is crashing with no survivors and every dip will be a buying opp from here on out.