Just a little over eighteen years ago I sent a warning just as the Great Financial Crisis was about to accelerate and cast its dark shadow over our nation, that the government and Federal Reserve might choose the Weimar route to attempt to inflate our way out of one of the greatest financial crises since the Great Depression.

In the article, “Weimerica“, these pages stated the following:

The average American citizen has abandoned his or her responsibility to invest wisely, save carefully and shop for the best price. The mentality of “the government will save me” has taken over, but let’s does some more numbers. Based on the current national debt, we will all have to pay a 90% income tax rate for 70 years to pay off and meet all obligations according to some “experts.” And that is assuming 5% GDP for those 70 years.

Obviously, the Federal Reserve, the government, and global bankers decide to punish the lower and middle class via asset and wage destruction during that era rather than allowing all of the financial institutions to fail who created, inflated, and destroyed the system by encouraging irresponsible behavior in coordination with their political whores in Washington, D.C.

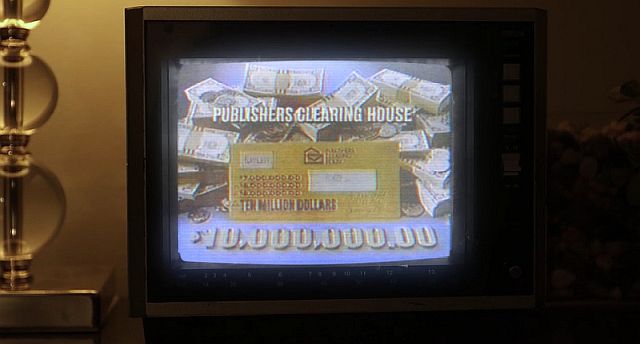

Meanwhile in the United States, people gambled on the lottery, online casinos, or contests mailed to them randomly by companies like Publisher’s Clearing House and the lucky souls who won got great prizes like $5,000 per week for life. As long as the American public kept subscribing to print magazines, the money kept rolling in and the purchasing of annuities to fund these prizes could go on forever.

Until it didn’t.

On April 9, 2025 the company made famous by Ed McMahon’s commercials filed for bankruptcy.

So what does this have to do with the title of this article. Perhaps the story linked below from KGW News 8 in Oregon might provide a stark warning what happens when one puts too much faith in older institutions making promises that could never be kept.

Oregonians won ‘$5,000 a week, forever!’ from Publishers Clearing House. Then the company went bankrupt

Here is the money quote from the article:

“You won $5,000 a week, forever!” a member of the Prize Patrol said with TV cameras rolling.

John Wyllie of White City, Oregon thought he was set for life. The jackpot allowed him to retire. Wyllie moved closer to his kids and bought a house on six wooded acres near Bellingham, Washington.

Every January for the past 12 years, Publishers Clearing House deposited a prize payment of $260,000 into Wyllie’s bank account. But this year, the money never came. In April 2025, Publishers Clearing House filed for bankruptcy.

“Why didn’t somebody give me a heads up? ‘Hey, we’re going out of business,’” Wyllie asked. “It’s not a good way to treat anyone.”

The emphasis on the last sentence is my own. Why? Because I’m giving my readers, again, a “heads up” as to why you never pass a gift horse in the mouth nor accept a long term payout deal from anyone as a promise that will be kept in a debt laden crony capitalist society.

Wall Street promises you 7% per year for decades? Don’t believe a word of it, educate yourself before you lose everything.

Banks will never fail again after the GFC? Do not be a moron. Silicon Valley Bank was just the warning shot.

Social Security will always be there for me! Of course it will. Too bad it will cost you your entire Social Security monthly check to buy two cases of cat food to feed Muffy the Wonder Cat and yourself.

In a nation which is facing a debt load of over 123% and if off the books obligations are added, it is probably, far, far worse, there are only two paths out of such a crisis as the debt is now compounding with each Omnibus Pigulus spending bill passed by the Congress.

The first path is default and deflation, something the United States has done in the past several times to varying degrees.

The second path, the one that we appear to be on now, the nation must inflate or die as the great Richard Russell once warned.

This brings us back around to that poor sob in Oregon who now has to re-enter the workforce into a very dicey economy. Take the lump sum every single time boys and girls.

Because in a few years with the inflationary path we have chosen, it could be worth considerably less.

Don’t believe me, then I would suggest my readers read up on the Reichsbank President Rudolf Havenstein and his solution to Germany’s impossible debt problem in the 1920’s. America just might be foolish enough to try a new modernized version of the same insanity to cure what will be ailing the next generation of American suckers sooner than one thinks.

That's not bad advice. "If you don't hold it, you don't own it"