However, yes Virginia, there is a Santa Powell!

The good news for all the little baby bull boys and girls out there is that Santa Powell will probably lead the charge at the FOMC meeting next week to cut rates.

The bad news is, well, why you’re reading a macro-bear’s webpage for a non-mainstream propagandist point of view.

First, let us review the Atlanta Federal Reserve’s Sticky CPI tracking which in this author’s opinion is one of the best gauges of Consumer Price Index inflation out there, and it isn’t getting better or worse per their publication this morning.

Unchanged from last month but still substantially above the fictional Federal Reserve target of 2% which it has yet to hit barring a major deflationary episode.

Is 3.4% high for this index heading into a recessionary period?

Let’s check out the last big recession that started in 2007 for the inflationary peak according to the Atlanta Fed:

And yes Virginia, we’re still higher than the nasty inflationary spike pushed higher by food, energy, and housing prices of that era.

But looking back in history was it that bad in the post gold standard world order of the 1970’s? The answer is a resounding yes:

The weirdest part is the ‘bullish’ argument that the Fed never cuts heading into a recession and has gotten so much better throughout history controlling interest rates pretty darned well to prevent inflation from getting extreme. In 1973, there is dramatic evidence that we can all repeat the great Lee Corso line, “not so fast my friend!”

Oddly enough the Effective Fed Funds Rate in Sept of 1973 marked a peak and then declined heading into a recession. But that didn’t make the 1974-1975 recession that bad; or did it?

Oops.

If anyone thinks that an inflationary recession is an impossibility, one only has to look at the closest post-gold standard cycle of rate increases from the Federal Reserve and inflationary spikes paralleling a poor reaction time by the FOMC.

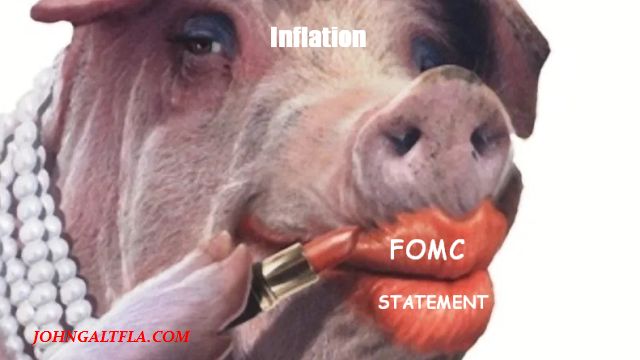

So while Jay Powell may want to dress as Santa Clause and jack the bulls up even further, one just has to remember how the Federal Reserve Chairman who was selected by Nixon fared towards the end of his term.

And no Santa Powell, you’re no Paul Volcker.