Traditionally, Labor Day marks the end of the summer for the American public and the beginning of full time work and school for families all across the land. In the worlds of the stock market and economics, it also begins the greatest seasonal period for problems despite those talking heads that believe there will never be another bear market or recession in their lifetimes.

This belief that a “new” way economically has been the hope of every economist and stock market huckster since the inception of the Federal Reserve in 1913 and played upon the emotions of investors every since. In 1964, the New York Times published an article titled (yes, in all caps) “ARE RECESSIONS A THING OF THE PAST?” The money phrase from the story was the opening paragraph where it was stated:

Are recessions necessary?

This question, almost unthinkable five or ten years ago, has become a topic of serious conversation among economists and others as the American economy sets a record with every succeeding month for the duration of a period of peacetime business expansion—with no end in sight.

Emphasis is my own of course because where have we heard that before? The Reagan boom, the 1990’s through the .com bust, the Greenspan Bubble started with the great reflation in 2003, and of course this era where artificial intelligence is going to cure all of mankind’s woes.

Naturally what everyone forgets, as bad memories are something we can not allow during euphoric bull market periods, is that after that June 6, 1964 article, President Johnson bullied the Federal Reserve and then Nixon took over in 1969 to preside over the eventual easy money inflationary period that lasted a decade. That of course stuck President Nixon with a tumultuous economy where equities were in a cyclical bear market from November of 1968 that did not really end until August of 1982.

The 1929 Warning

“Nowadays people know the price of everything, and the value of nothing”

–Oscar Wilde, The Picture of Dorian Gray

In 1929 the market could only go up. The new modern technologies of the era promised a revolution that would forever end the concept of depressions and recessions as the young Federal Reserve and modern economic technocracy envisioned by Hoover and his supporters would never allow such an event to occur again. This author’s favorite stock chart from the era tells the tale of the tape for that time period, RCA:

Weird, it looks like Cisco in 2000, or Nvidia today, or even the entire stock market in 2025.

But the headlines of that period were just as similar, as if the artificial intelligence boom today is nothing but modified headlines and story lines from the past:

November Sales 50% Ahead

Sales Increased 38% over 1928

Sixty Percent Ahead of 1928

Increase 148 Percent; Christmas Prospects Splendid

Year will show 100 Percent Increase

That snippet of headlines is from this magazine, Radio Retailing which was the industry’s publication of record, via the December 1929 story “1929-Radio’s Biggest Year”.

I only bring this year up because the exuberance, the hubris, and the blind eye to the underlying rot of the broader US economy is almost perfectly identical to this current era. In fact I would not be shocked if US equities make one more run at a new all time high next week to parallel the insanity to the date as on September 3, 1929, equities reached their all time high and the headlines in local papers reflected this.

Be prepared to witness more calls for a permanent bull market should this occur next week, but remember; the bear market which started in September of 1929 did not really end until late 1949.

The .Com Disaster

“The fact is that markets behave in ways, sometimes for a very long stretch, that are not linked to value.”

-Warren Buffett, Chairman of Berkshire Hathaway, Fortune Magazine, November 22, 1999

The younger generation will reply to that quote above by stating sensationally stupid things like “that’s from an old guy from ancient history” or the ever infamous idea of “we’ve evolved past that era, so don’t worry about all of my options and memecoin trades.”

Yikes.

But old Warren was basically mocked back then also. A lot of people do not remember that the media and the go-go tech freaks of that time consistently mocked anyone who doubted the durability of the cyclical bull which began in 1988 and survived not only the Gulf War recession, LTCM, and a Presidency embroiled in daily scandals.

The belief then, as now, is that this bull was bulletproof and the the bears stand no prayer against the emerging technologies which will lead to a brighter future.

Ironically an article appeared on March 6, 2000 in Fortune Magazine title “1980 Revisited” where the author warned that the tech bubble would pop despite the protestations from the tech religion that it was impossible. That was written and published just four days before the Nasdaq hit it’s all time high, something it would not see again April 23, 2015, some 15 years and just over one month later.

Think about this next week as one listens to the “it’s different this time” calls via social and mainstream outlets.

GFC, JFC

“They Know Nothing!”

-Jim Cramer, CNBC, August 3, 2007

I remember starting my writing and radio career in 2007 because some crazy souls found out that I had been watching what was happening in Florida and warning everyone to start buying precious metals because the banking and financial system as a whole was at risk.

Eighteen years later I think people might be tiring of this same bearishness that I am expressing but bear markets don’t just suddenly appear like a stripper inside of a cake popping out on a Navy ship. The deterioration then, as now, starts with the lower and middle class and seeps up the food chain to the top 5% and that’s when the panic, the despair, and reminders to crashes past are broadcast with the “see we tried to warn you” at the same time they are running advertisements for triple leveraged ETFs on some shitcoin being pushed by a former host.

Some perspective is in order as when the Dow hit an all time high in October of 2007 as highlighted in that CBS News story above, it was easy to warn about the equity market’s irrational behavior because credit markets were flashing all types of warning signs, along with the private credit markets at that time. But the belief in the infallibility of that bull market was highlighted by this single quote, which was a somewhat widespread belief, from the article linked above:

Investors bought financial shares on the belief that the industry has generally weathered the recent credit market upheaval.

What most younger investors do not understand is that for those who were totally immersed in the equity markets in late 2007 during the final chance to escape was that those who remained and were not impacted by companies being liquidated it took 5 1/2 long years for the markets to return to those lofty highs.

The market rally hard off of the March 2009 lows because the belief was instilled that the Federal Reserve and US Government would bail anyone and everyone out of trouble, even though the poor and middle class homeowners where swept away like love bugs hitting the windshield as foreclosures skyrocketed in 2009 and 2010.

Sometime around 2011 the Fed floated an idea that perhaps Quantitative Easing was no longer needed and the equity market quickly fell over 2000 Dow points as markets started to seize up. After months of market instability and more stress appearing in the financial system, Ben Bernanke stepped up before the microphones on September 21, 2011 and announced a new modernized version of Operation Twist and off to the races the markets went again.

Bulls Make Money, Bears Make Money, Pigs Get Slaughtered

“It is unfortunate for the general public when such a condition arises that real sound investment issues have to suffer to some extent along with the readjustment of issues of less merit.”

-Jesse Livermore, newspaper quote via UPI, October 1929

This brings us to the bubble which America now lives in today.

Jamie Dimon, the CEO of JP Morgan Chase warned regulators that when the bond market cracks “you are going to panic” and that understatement from May of this year should have been heeded. Instead of doing what the administration has promised to shift the debt being incurred now further out into the curve, Treasury Secretary Scott Bessent now realizes that the excess spending authorized in the “One Big Beautiful Bill” has added one trillion dollars of debt to the total since May and America’s spending addiction can only be satisfied on the short end of the curve for now.

At some point, the long end will crack and every aspect of America’s financial system will panic with the regulators.

The problems our nation started with Alan Greenspan’s bailout of the major banks in 1998 due to the LTCM crisis, the easy money solution which fueled the housing bubble starting in 2003, and of course Ben Bernanke’s QE forever policies starting in 2009 are about to come due. Unfortunately it is about to hit a generation of traders and investors who have never lived through a cyclical bear market, much less a violent correction or crash.

If this is the era or time frame for a market bubble to pop, I know of few circumstances which fit the coming ninety day window better.

Let’s use the S&P 500 for our basis in the following discussion.

The first stop is probably to fill the first of the three little piggy gaps and a 10% move down just below 5850 would be considered a “normal” correction in the context of this sixteen year bull market. The area where a little panic would set in is the 18-20% decline area between 5200-5400 and then it gets interesting.

The last gap is around 4400 and would represent an over 30% decline in the market and would generate in this author’s opinion, another classic Jim Cramer rant. Would the carnage be over however, if the three gaps to the downside get filled?

In this author’s opinion, no.

If the government does not intervene at the Fibonacci level of a 50% retracement, the Covid gap between 2500-2600 will be filled and odds are the 61.8% Fibonacci level would probably get kissed.

How could this happen? In over-leveraged markets with too many unique trading instruments that have never been tested in a real bear scenario, much less a real ‘crash’ that the American public, young nor old, believe the government or bankers would ever allow again.

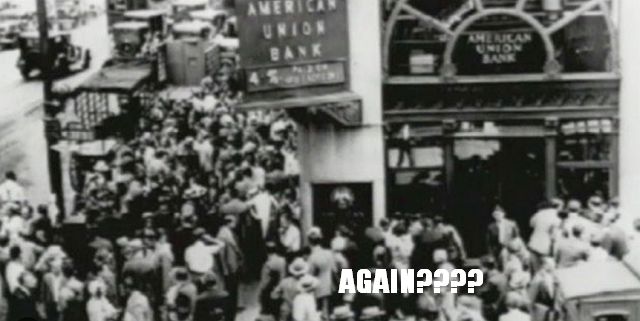

The big secret is that the banks nor the government never know when a crash hits nor how to deal with it other than throwing money into the fire and praying. The other revelation that the majority of the investing public ignores is that deleveraging, especially forced deleveraging, occurs much faster on the way down, than asset price leveraging does on the way up as banks will take whatever actions are necessary to protect their core assets over the average individual.

The economic situation America is facing now is a rapidly spreading white collar recession which is devastating the middle and upper middle class while in parallel, the embedded inflation started in 2020 and accelerated over the past three years is ravaging the lower class; especially the elderly living on fixed incomes. Just as in 1929, 1999, and 2007, the powers that be assured the investing public that everything was under control and the economic impact of this change in our society will be great for the long term.

The retail bagholders have been trained by the Fed and the US Government since 2009 that no matter what one or both entities will bail them out. Lose your job? Call it funemployment and the government will give you cash. Lose $100 billion on suspect accounting and poorly chosen investment instruments? No problem, the company will be deemed too big to fail and a bailout would be forthcoming.

The problem is that once the inflationary cycle generated by the Fed’s actions of 2021 along with the end of the short term tariff price spike is over, a great deflation will probably begin and markets unfortunately will recognize that before the general public; just like the smarter firms and corporate insiders in the bond and equity markets did in 1929, 2000, and 2008.

Due to decades of persistent inflationary pressure, the average soul has no idea what a great deflation looks like nor how leveraged assets can deleverage during a period of deflation. The market price of their home could be worth $600,000 on Monday and three months later half of that. A seventy-eight year old retiree’s retirement account he has been drawing on for almost twenty years could lose 50, 60, even 70% of its value, leaving the family devastated. Imagine being an elderly soul looking for work in a paralyzed economy that has no desire to hire an older man above age 50, much less age 75.

The social safety net is not designed for the residential and commercial real estate markets in addition to broadly owned financial assets to decline in a deflationary spiral simultaneously; nor is the government capable of reacting fast enough to deal with the consequences in a timely manner. The political paralysis generated by partisan conflicts and strong personalities infesting our government means that much like 1930, inaction will only complicate and probably prolong a deflationary cycle that expands globally throughout the West.

This means the great deflation will continue feeding on itself until economic contraction could potentially be as dramatic as 5 to 8% per quarter if left unchecked.

The American public is about to endure a period of geopolitical, domestic political, and economic uncertainty unseen since the 1930’s. Unfortunately for an average person, the consequences are quite difficult to navigate due to the individual isolationism created by years of poor education in parallel with the evolution of the internet and social media. What is worse is the disbelief that such a drastic outcome can or will occur.

The era of papering over mistakes and promoting the decades of the Greatest Financial Fraud in history is about to come to a violent close.