I could easily sum up the press conference and statement with a music video:

Unfortunately for those who think the Federal Reserve actually has a clue what to do, galactic bureaucrats are not going to destroy the earth before the Fed and government destroy the currency to create a hyperspace superhighway.

So with that cheerful thought, let’s move on to dissecting the insanity of what happened today and preparing a dartboard to guide one into what is coming next.

First and foremost, when the FOMC issued its statement, the markets reacted rapidly to the upside with the Dow Jones Industrial Average up 375 points fairly quickly. Then Sir Ben Bernanke, oops, my bad, Jay Powell began to talk and distribution hit the markets with a vengeance.

What made matters worse is how the Fed statement flowed. Here are some key excerpts from the FOMC statement and some reflections for my readers to consider.

Recent indicators suggest that economic activity has continued to expand at a solid pace.

Absurd and not worthy of comment. Next.

In light of the progress on inflation and the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/2 percentage point to 4-3/4 to 5 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

If the economy was slowing at such a pace to justify a 50 basis point cut, then the cessation of Quantitative Tightening, at least of agency MBS and certain Treasury securities would seem to be justified. Thus if inflation is “tamed” as the various financial media promoted today, the need to allow the runoffs in various holdings which support housing seems contrary to the rate cut, as a cut in the Fed Funds Rate is ineffective to lowering the 10 year US Treasury yield. Which, by the way, is the key factor for thirty year mortgage rates, not short term overnight borrowing rates.

Next:

The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

So the Fed admits it will continue to relay on backwards inaccurate data provided by the Bureau of Labor Statistics, which requires massive revisions to inflation and employment data on a monthly and much more massively, annualized basis.

Seems sort of a foolish decision to me, but hey, I’m not a politician running a central bank.

The financial media was not much better in understanding what was said and happening after the FOMC meeting and before the Powell press conference as the following posting illustrates:

Unfortunately for old Mo, Chairman Powell did not help him with an adequate explanation of the health of the labor market during the press conference. From the transcript:

…QCEW report which suggests that maybe that not maybe but suggests that uh the payroll report numbers that were getting, may be uh artificially high and and will be revised down you know that um we’ve also seen an anecdotal data like the beige book and so we we we take we took all of those um and we went into blackout and we thought about what to do and we concluded that this was the right thing for the economy for the people that we serve and that’s that’s how we made our decision.

The portion from the live transcript of the Chair Powell press conference is the most important admission by a Fed Chairman during one of these Q&A’s since Ben Bernanke acknowledged belatedly that subprime mortgages and derivatives might create a financial problem for the American economy.

Why is this so important?

The decisions undertaken by not only the Federal Reserve but financial institutions on a global scale move trillions, not millions, not billions, but trillions of dollars based on the data that is provided by the United States government and its institutions.

This admission by the Federal Reserve in addition to the sudden necessity of a 50 basis point cut should undermine confidence, the only thing supporting the US dollar and its instruments, of domestic and foreign investors equally and begin a quiet liquidation of the longest dated instruments issued by those institutions.

Nothing else that was said today matters.

Once the investing world loses faith in the US institutions, liquidating long date holdings will become priority number one because who wants to be a bag holder of a devalued currency on a 10, 20, or 30 year basis?

The US 10 year yield behaved logically and as expected of course after this press conference:

To the uninitiated, an 8 basis point move higher might not seem like a lot, especially considering the volatility that has been witnessed in credit markets this past decade. But during a Federal Reserve Chair’s speech, that’s one hell of a move in the opposite direction of the desired outcome.

For the near term, expect a reflex rally as the ignorant masses are told what to believe by the babbling bubbleheads with outlandish proclamations that this will help housing and car sales, which are totally unrelated to the Fed Funds Rate, and how the little guy on Main Street will get some relief.

That is what anyone who knows anything about finance labels “Bovine Scatology.”

After several days of euphoric praise for Powell’s “bravery” to save the employment picture and conquering inflation, the smart money, aka bond market, will once again lead the way. I look for the 2s10s spread to widen further, probably north of +0.15% fairly soon and as it eventually moves past +0.25% that’s when equities will get dicey as hell.

Do not be shocked if geopolitical, domestic political, and economic events trigger a massive one day equity liquidation of 5 to 7% or worse within the next 6 weeks, 8 weeks at the outside.

The Federal Reserve didn’t cut logically, it cut politically to maintain the status quo.

The consequences of which will be a potentially decade long stagflation scenario with periods of an inflationary recession followed by wildly fluctuating interest rates, zero to near zero growth, and more inflationary periods in an almost endless cycle.

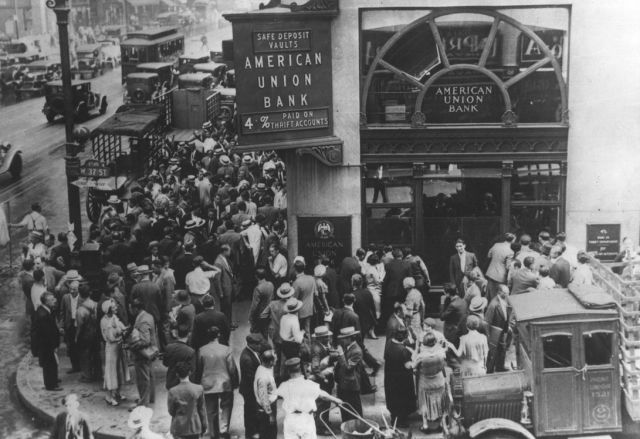

The monetary trap was set in 2022 and all it took was excessive fiscal spending and a Presidential election which could determine the current Fed’s structural survival for Jay Powell to fall into it. Sadly, for the poorest in our society, this will be the most brutal period since the 1970s and perhaps, the Great Depression.

FUCK THE POOR! AMIRITE? YEAH! HIGH FIVE! C'MON; DON'T LEAVE ME HANGIN…