Thursday morning began with a hard Mr. Slammy of selling against precious metals and this headline for all of those of us considered “goldbugs” which of course created the perfect storm:

Uh oh.

Then of course the FinTwit (Financial Twitter/X) commentary lit up and that should make even more people think.

Normally I would have tagged JP Morgan or old Mo’ with the proverbial “Captain Obvious” mocking gif but it was too easy.

Meanwhile there were many others.

And another one…

I love Kathleen’s posts but she’s behind the curve if one is not mocking JP Morgan today.

Why do I say that?

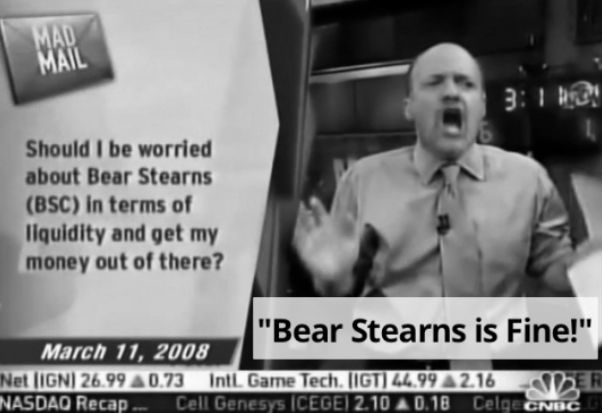

Lazy analyst garbage from some two bit analyst who ignores things that were posted back in JANUARY which said the same thing that thankfully Matthew Sigel captured:

Yikes!

So what is the debasement trade per se?

Everything these pages have been warning about for over a decade.

There is a massive belief that the current version of the Trump administration will do anything within its power to devalue and debase the US dollar. Of course what they fail to realize is that there are consequences to their actions and even a subtle devaluation results in a rush to hard assets and commodities.

However, it’s not 1972 any longer which means that with the ability to move billions into alternate assets, bitcoin becomes a repository for investors desperate to not get trapped should the dollar devaluation become an open announced policy choice versus the obvious secret it is now.

How is retail jumping into the game besides buying precious metals ETF might be the easiest question to answer. Traditional coin shops and online stores are hitting buyers with premiums anywhere from 3 to 19%! Thus an opening was created by market demand with a volume player offering low premiums and easy accessibility for the masses.

The reality is that Costco lead the way and of course that triggered a wave of retail buying.

In the news on Thursday was their first offerings of fractional gold bars is a major indication of a warning sign that demand shows no signs of abating.

However, this is not THE top, but potentially the indication of a short term top.

History Repeats?

From the really, really, old JohnGaltFla.com website February 4, 2010:

Be Leery of this Parabolic Move in Gold

Nothing has changed. This chart is still valid:

Thus while the deflationistas will run around saying “see I told you so” just smile and buy on these key dips. The massive move up is not over. The consolidation is still intact and the 1014 level on the gold futures has not been violated. Thus patience and wait until that last gap fills, take a measure of what is happening. If you’re a survivalist buying to preserve future wealth these drops are literally golden opportunities.

Tomorrow I will address the jobs number which I figure will be +/- 30K and the claims from this morning all in one package. The disaster which is this administration attempting to personalize and modify the Bush-Paulson fiasco of plans is only making things worse and I mean much worse. The failure to address and allow the mortgages to collapse and be counted at true valuations on the books of the financials has instead sowed mistrust and will precipitate a massive bond market crash, not just in the paper the banks issue but in our government debt issues. That will be the merger of the 1937 flashback with the proverbial Minksy moment. Get ready for a wild ride gang which will probably end with 25% unemployment in U-3 terms and 12% yields on the 10 year Treasury IF the idiots do not do a thing or elect to not monetize further. Thus I think when that moment hits, some seriously dangerous and rash decisions will be made. Thus when all hell breaks loose, the rank amateur policy decisions we would expect from this group will be enacted. Prepare accordingly.

So just what does this old article have to do with retail finally buying into the surge in gold, panic buying into safety, etc.?

Hopefully this blast from the past provides some food for thought.

Why?

Gold Doesn’t Repeat, But it Does Warn

The following chart sums up the article from that era and the current time frame those based in reality are all living through:

I called it then.

I’m calling it now.

When I wrote the article, Is Gold $4000 Next?, I was dead damned serious. I missed the call for higher prices this year than the $3600-$3800 range I projected in December of 2024 as there was no way any rational human being could have projected that this administration would act as irrational in economic policy as they have.

Thus with retail finally getting serious about diving into the gold and silver trade as a hedge against geopolitical and economic instability, substantially higher prices are probable in the near future. The more terrifying aspect of this is the global instability created by this administration’s foreign policy adventures might drive the price far, far north of $4000. This is not only an indication as to the lack of trust in the American political system, but the current economic outlook for our nation in the years ahead.

Retail buying more gold is not the end of the precious metals rally, only a sign post that global investors are finally listening and hedging against potential catastrophic losses in the casino known as Wall Street.

if you’re not buying pre-1965 US silver coins you’re missing the most obvious trend there has ever been. Historically the gold/silver ratio has hovered around 10 to 1, right now it’s about 100 to 1. My guess is it means silver is very under valued or gold is over valued. It’s likely a bit of both which suggests silver will climb.