Last night I highlighted what was a lackluster quarter of equity trading which continued today with more institutional distribution but low volume and very poor breadth. Gold once again was taken to the woodshed and the culprit, besides soaring US Treasury yields is what usually follows in tandem:

King Dollar is destroying the price of gold in US dollars. It’s obliterating silver priced in US dollars also.

One of the FinTwit bloggers I follow discussed this with his chart and observations in this posting:

The last time gold was as oversold as today was in 2018 at $1,200/oz.

— Otavio (Tavi) Costa (@TaviCosta) October 2, 2023

Two years later it hit $2,000/oz.

H/t: @bonker_99 pic.twitter.com/NMFgjVpHBN

Normally, I would agree with his analysis. The problem is that there is no apples to apples comparison using RSI because of several factors:

- Geopolitical instability isn’t to the point of making gold a viable option.

- The US National debt and deficits were not even close to how high they are now.

- QE was still fully engaged in 2018 and there was a similar mentality in December of 2018 for gold as there was during the Great Financial Crisis(GFC).

- Inflation, even BLS fictional versions, was relatively tame during the 2014-2018 time period.

Thus let’s review gold’s performance during the GFC when it was liquidated ferociously before it rallied to new highs.

If one notes, as the severity of the crisis unfolded, more gold was sold to raise cash to cover losses. This is not unusual but in the period from the failures of Fannie and Freddie through the maelstrom of September 08 through December, gold remained weak as holding cash, physical cash, was more important.

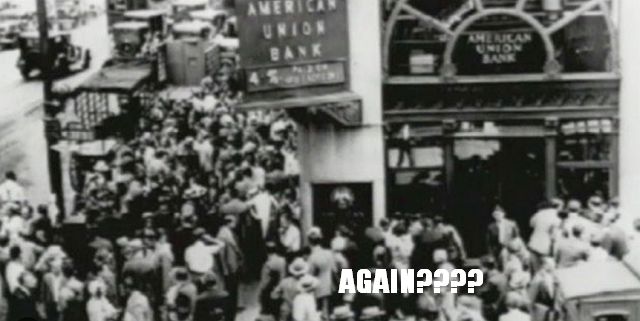

Gold might be, as are the major currencies, and the US Treasury market overseas, sending a warning about the credit worthiness of the United States and its ability to finance our lavish spending into the future without permanent stagflation. Keep in mind, the rest of the world is evolving with new financial arrangements being made between nations almost daily.

In the end however, settlements in US dollars will continue as while Rome wasn’t built in a day, the Pound Sterling did not collapse in a year also. Thus as nations with dollar denominated obligations need the currency, the valuations will stay higher for longer until something better can be implemented.

As of this writing, it is my opinion that gold has a reasonable chance to test the low to mid $1600 range before consolidating and silver settling around a range of $16.25 to $17 before rallying next year. There is one wild card and that is of course geopolitical unrest. At that point in time, all bets are off because no one has a clue as to what will truly become the flight to safety until the dosimeters start to calm down.

If the precious metals complex does test those ranges however, I would back that truck up immediately because at some point, the Fed will have to bail out the US Treasury market, and that would be somewhere north of the US 10 year breaking above 10% yields.

That Federal Reserve version of Quantitative Easing would have to be so massive that King Dollar would finally face its ultimate test:

Hyperinflation.

If gold tests the Nov 2022 lows ($1650-1620/oz) I will once again be a buyer. I always buy physical in the troughs, and I hold for the long. If you look at the gold price on a monthly or year-over-year YTD basis, you’re doing it wrong.

Gold is measured in decades. That’s how I measure its value. And if you do so too you’ll seldom be wrong.

I’m right there with you as I said. I will buy at that bottom along with silver in the teens. Because we are not entering into a new era of economic and political instability.