The American people have a notoriously short memory so this one excerpt from Paul Volcker’s New York Times editorial A Little Inflation Can Be a Dangerous Thing of September 19, 2011 is a great refresher for yesterday’s CPI print:

“The danger is that if, in desperation, we turn to deliberately seeking inflation to solve real problems … we would soon find that a little inflation doesn’t work … What we know, or should know, from the past, is that once inflation becomes anticipated and ingrained – as it eventually would – then the stimulating effects are lost.”

When Mr. Volcker penned that editorial, then Federal Reserve Chief Ben Bernanke was torn between tapering QE or pushing full speed ahead to prevent a relapse of the 2008 collapse. The banking system was still quite unstable, the housing market barely recovering, and employment levels just beginning to normalize despite Fed actions and the wasteful, ineffective government spending initiated by the Obama administration. With the willing aid of the Obama regime, Bernanke was able to cover up the mess by the fire hydrant, and the elites made out like bandits while programming the sheep to believe that government would never allow the 2007-2009 economic crash to ever happen again.

Yesterday’s CPI print was a nightmare for not only a now departing Federal Reserve, but a major political albatross for the Biden junta if one considers that the comparisons to Jimmy Carter which began with the Afghanistan debacle now have even more validity. For the younger generations who were not around in the late 1970’s and early 1980’s when I was in college, the rapid price appreciation is a stunning wake up call. Almost two entire generations have grown up living through relative currency and price stability, with few interruptions to the economic expansion beyond 2001 and 2008.

Reality comes at you fast, as the expression goes, and those who did not experience the late Carter years are now in for a very rude awakening on several levels.

A young lady named Madison on Twitter decided to post the price changes at the store she works at as an example of the inflation the average citizen is now enduring:

I put up price tags at the store I work at. Here are some price increases I’ve seen so far pic.twitter.com/h4VHEt3Cge

— Madison (@prolife_madison) November 4, 2021

The gas prices that the gas bag Wolf Blitzer posted from Washington, D.C. at the top of this article is another example. But the financial world generally ignores those anecdotes until the data hits and yesterday it hit with a headline 6.2% annualized print.

The reality though is much worse as demonstrated via ShadowStats.com:

Even the Atlanta Federal Reserve Bank validates the ShadowStats inflation trajectory comparable with 1977-1981 with their own CPI data via the flexible data versus sticky CPI they calculate on a monthly basis:

This begs the question then:

Why didn’t the Federal Reserve begin a serious effort to contain inflation last week during its recent board meeting?

I answered that question one week ago as Jerome Powell will soon be recognized as the second coming of Arthur F. Burns as the Federal Reserve Chair who enabled the great inflation of the late 1970’s. In my article The Federal Reserve’s Blunder Has Arrived I warned about the following:

Once the rapid expansion of inflation deteriorates to an almost hyperinflationary pace, demand will collapse resulting in a destruction of financial assets unseen in this nation since 1837. When people can no longer afford the staples of life, investments in real estate or necessities, then the last domino will fall crushing anyone who failed to take profits and hedge properly when the economic system collapses.

Keep in mind, I made that statement before the CPI print yesterday, and as the shortages accelerate in unison with rapid price appreciation, it will only get worse in the next year, not better. Don’t believe me? Check out this story from the semi-official state propaganda organ, the Associated Press:

Maine residents brace for power rate hikes over 60%

In my real life away from the internet, I am not a professor nor mathematician, but 60% is substantially higher than the “official” 6.2% CPI level where I come from and the implications on the economy of that one state are mind boggling. But why would the global central banks and political leadership allow the supply chain and monetary systems to become so dangerously unstable with the policy of deliberate inflation?

The answer, I am afraid, is quite simple:

The Great Reset

So what does my reader having to pay $7 for a loaf of Wonder bread in January of 2022 have to do with the Great Reset?

Everything.

The final purge, after the Great Plandemic to restrict individual freedom, requires a true reset of the financial system. The global elites even say that in the link above about their Great Reset which requires mandatory participation by the majority of global citizens regardless of their personal desires.

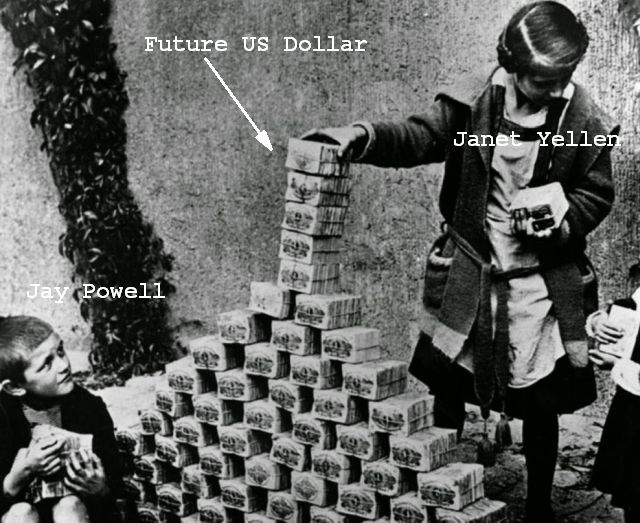

To implode the American financial system and currency once and for all, the only method to succeed is to create a great hyperinflation where the United States might well see 25% plus non-seasonally adjusted annualized CPI by the 2nd Quarter of 2022. The U.S. Dollar must be reset and removed as the global reserve currency to ensure submission by the majority of the American public, otherwise the big plan will not succeed.

The plan seems to be working with flexible CPI hitting 13.5% last month (goods and services everyone uses frequently) and on pace to exceed 15 to 17% in November of this year. The assault on fossil fuels is succeeding with gasoline prices expected to average north of $5.00 per gallon for regular unleaded by January of 2022; possibly even north of $7 by March 2022. Add in fertilizer prices hitting record highs yesterday and the prospects for reduced planting and harvests moving forward will add to food scarcity. The packaging price surge has not abated since earlier this year along with shortages of numerous raw materials used in the manufacturing process. Combined, this nightmare looks to be getting worse for the next 12 months, not better, adding fuel to the hyperinflationary fire.

Yet our political leadership appears oblivious, but in reality they are not. Look at what has happened in the last three months:

Fed’s Randal Quarles to Resign at End of Year – WSJ

2 Top Federal Reserve Officials Retire After Trading Disclosures

Jerome Powell’s Stock Dump Doesn’t Look Like Insider Trading

And those stories do not even come close to the amount of insider trading executed by members of the three branches of the US Government.

To collapse the system, one has to corrupt the system, and to have those engaged in legislative, judicial, and financial control trading in the very instruments they control for personal profit would seem to mark the top of every speculative market. Many of them are retiring, taking their ill gotten gains and fleeing before they are blamed for the reset and damage to the average American citizen’s standard of living.

Meanwhile, the media continues to run cover for their actions with absurd stories like this one (which was withdrawn after blistering criticism):

Or this snippet of headlines from the media trying to cover for the elite’s actions:

The masses will all claim, like robots programmed in unison, “see, inflation is good” having no clue that their own crypto fortunes, paper equity gains, or personal real estate profits will be obliterated with 20%+ annualized CPI. They have been programmed for almost 40 years now that the the government would never let bad things happen to them.

That perverse view of reality is about to end.

The Great Reset will wipe everyone out; everyone who is not prepared and believes the foolishness we are witnessing right now is the Metaverse of reality.

Got preps?