The financial media broke into its usual “see we told you so” hyperventilation after gold broke to the downside on Friday after this story hit about the PBOC stopping purchases of gold in May:

What the media did not say was that the PBOC may have stopped buying gold for its reserves, but Chinese citizens and financial institutions probably continued to load up when and if they could find any available physical supply.

This is typical of the media as every time gold has a “big” selloff they proclaim it dead and buried. Here’s an example from this past April where the reporter from Fortune magazine misses the bigger picture:

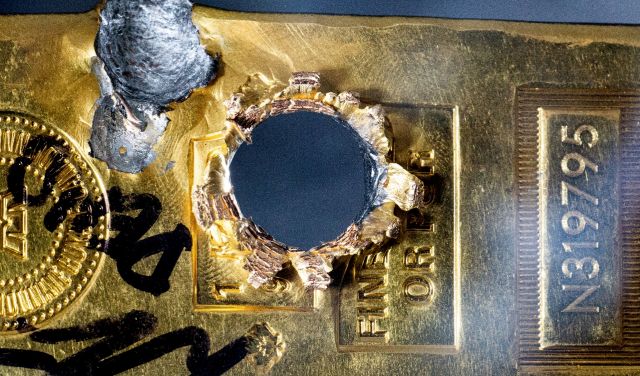

Costco keeps selling out of gold bars. Experts warn rush is more ‘mob mentality’ than sound investment decision

These same “experts” told many investors to hold Cisco through 2000 because it was just a bump in the road, get rich quick investing in real estate in 2006, and AirBnB investments are the future.

The most recent economic crisis is the best basis for understanding how this precious metal behaves throughout a crash, thus ignore the pandemic a true one off, and let’s reflect on the Great Financial Crisis (GFC) which in reality was a two year economic depression from December of 2007 through the end of 2009.

Essentially that chart is just a summary of gold’s behavior during the crisis which in reality was detected by the gold bulls in early 2006. But when one breaks down the periodic segments of declines with each cycle of crashes and crisis, it is easy to see why a one day, week, or month pullback causes the gold sucks crowd to start clucking like overheated chickens.

For example, let’s look at early 2008:

Why would gold sell off during the Bear implosion? Simple, investors and financial institutions needed to raise cash in a hurry and gold is one of the most liquid markets on earth. Thus when more banks failed in April, it became apparent cash wasn’t king, but raising cash to meet margin calls and cover for other financial issues was.

Then the summer of 2008 hit and it was on fire. From July of 2008 onward, it got ugly fast:

If one was not around for October of 2008, one could not appreciate just how close the entire system came to a complete and total favor. Those of us considered “preppers” or “survivalists” who had been warning about this honestly thought with the collapse of Lehman that society was on the razor’s edge.

Little did we know just how close to the edge we were as the Fed and Washington, DC insiders lost control. The attempt at a year end recovery were frustrating, and that that only prolonged the pain as millions more citizens lost their jobs and banks were failing faster and faster.

2009 was the major turning point for both the markets and direction of gold and the American economy.

On December 8, 2009, I wrote the following in an article titled Death of the Gold Bull? Nah, He’s Hiding with Tiger:

The support area is the same. The move the same. The lies from the media the same. The “gold is dead you had better buy all those stocks the insiders are selling” from CNBC is the same. The Bubbleconomists all proclaiming that the U.S. Economy is recovering is the same.

The same words apply to the market today. The correction in gold from its first attempt to breech the magic $2500 mark could crater as low as $2100; below that I would get concerned. However there is another indicator of economic instability which might play into this market, and all aspects of global financial markets between August and December of this year:

No matter who wins in November, I fear the consolidation and range bound trading of the dollar, along with social unrest in the United States will play a major role in the value of the US Dollar. Note that I am not saying its usage for transactions globally, but the value comparatively to other nation’s and bloc’s currencies that do not have the societal and economic issues the US could have.

Thus until gold breaks below $2100 with massive volume, just play this as a buying opportunity for those who can afford to purchase physical if one can find it with reasonable premiums.