“Leave matters of the state to the state”

This past Friday the Bureau of Labor Statistics released its latest version of the Consumer Price Index and guess what?

It’s still way above the 2% theoretical target of the Federal Reserve.

Did anyone hear that from the financial media? Let’s take a gander as to what was reported:

Consumer prices rose 2.4% annually in January, less than expected

That’s from CNBC so that’s not a shocker, they need you to buy stocks or their very existence comes into question. So promoting all economic data as ‘bullish’ is what one would expect in a headline.

Inflation cooled in January, offering some relief for consumers

This one is from NBC News and while accurate on the surface, is it truly offering “relief” for consumers as the subtitle implicates?

Inflation cooled more than expected in January

That one is from Business Insider, but within the story this statement speaks volumes:

Core CPI, which excludes volatile food and energy prices, rose 2.5% year over year in January, as expected, just below the previous 2.6% increase

At no point do any of the stories reflect that the “core” rate is still above the Federal Reserve’s target of 2%.

Nor do any of the stories reflect an over 35% imputation rate.

Nor does the measurement of health care insurance or medical expenses reflect reality even in alternate Start Trek Universe’s where Spock has a cool beard.

Nor do any of the stories reflect the gaps created by the shutdown where the BLS just declared “shelter” (OER=Owner’s Equivalent Rent) at an impossible 0% inflation level during the shutdown gap.

This brings the doubt forward where one must refer to “alternate” measures of inflation over the longer term, no not Truflation which is more of a short term directional indicator, but embedded or “sticky” measurements that indicate the persistent cost on the middle and lower class of America.

Atlanta Fed Sticky CPI

As my readers know by now, these pages prefer the broader measures used by the Atlanta Federal Reserve Bank via their Sticky CPI measurement. For the month of January, the number indicates the US is still stuck at or above the 3% level:

With this persistent level of annualized inflation how bad is it really under the surface if as many websites have documented including this one, that actually consumable goods are averaging annualize price increases far above the reported feel good level reported by the mainstream and financial media?

Let’s take a look at a product which is truly reflective of the impact of tariffs, transportation, and inflationary policies on the American consumer.

Spamflation

Spam is, regardless of one’s personal tastes, America’s economical protein source in times of peace, war, or economic disruption.

To say that inflation is tamed at the consumer level, especially the poor souls residing and trying to survive in the lower leg of the ‘k’ shaped economy, is a lie designed to boost equity prices and investment in Ponzi-like equities to profit the souls smart enough to harvest the greed of the desperate and stupid.

But Spam, America’s canned meat product which rates just higher than grilled Vienna sausages, is the high protein solution created in 1937, still heartily consumed in Hawaii, and enjoyed by those who have a creative ability to create fascinating cuisine with compressed pork shoulder. I personally recommend learning how to make the bacon flavored Spam omelette, but to each their own.

But I digress.

Instead of hammering the BLS for using politically contrived methodology, something these pages have been documenting for 20 years, it’s time to look at a specific product and understand just how tariffs, trade, and the pandemic economic policies of 2020 are still impacting the American consumer.

In August of 2025, the following story appeared on the website, Food Business News:

Hormel Foods struggling to keep pace with rising costs

From this article, the following excerpt highlights just what has hit at the consumer level.

Specific costs highlighted by Smiley included pork bellies, which were up 30% year over year, the pork cutout, which was up 10%, and beef prices, which have reached near all-time highs this year.

“Collectively, we experienced approximately 400 basis points of raw material cost inflation in the third quarter alone, representing a notable increase relative to last year,” Smiley said.

To counter the rising costs, the company raised prices late in its second quarter, is implementing “targeted pricing” during the fourth quarter and is considering additional pricing actions.

“For profitability, we have announced inflation-based pricing actions related to the third-quarter markets, which we expect to partially benefit the fourth quarter and carry into the first quarter of fiscal 2026,” Smiley said. “As the fourth quarter has begun, counter to our expectations, commodity markets have remained elevated across a variety of inputs. With that, we’re assessing additional pricing actions.”

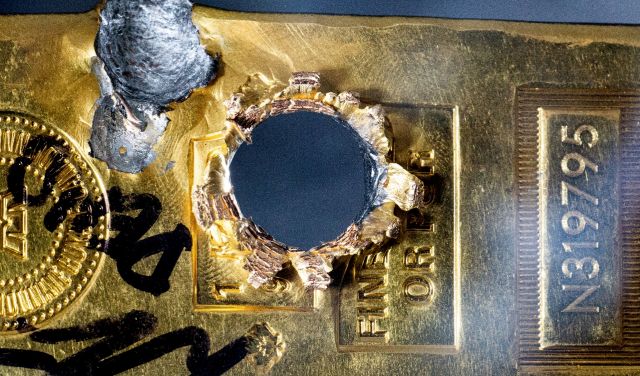

The emphasis is my own because if reflects the cost increases. Interestingly enough, the CEO and others did not include packaging costs for tin or aluminum which are up substantially since 2020:

Thankfully (?!) it’s only tripled in price. Yet the American public is led to believe that canned food prices are increasing because of foreign competition, not packaging prices or embedded commodity inflation.

What about aluminum, a primary packaging material used in everything from canned foods to canned beverages?

Yet when inflation reports are announced, especially for foodstuffs which the average American consumes on a daily basis, no consideration to these massive price increases is announced, analyzed, or considered.

To be honest, despite the incremental nature of these expenses, why else besides the absurd labor contracts the company signed, would a reduces size of a can of Campbell’s Soup accelerate to $2.00 per can?

So what has this done to Spam, a formerly low cost protein source for the American consumer?

While at my local Publix grocery store today, I snapped this picture of the product in question:

As most visitors and Floridians know, local Publix stores are always substantially higher in price than its competitors, when using this price basis compared to the past, it is up a healthy 41% in just a little over 5 years.

But what about at Walmart, a much more consumer friendly store?

Substantially cheaper than the major grocery chain but still reflective of a product which has almost double in price.

In fact when @Grok was asked to do a cost based analysis on this product, here is what it reported from internet records and prices provided online across the spectrum of grocers which publish such over the 2020-2026 period:

Annualized, this is about 5.7% annually, far, far, above the reported data and worse, way above what the Fed wants us to believe is their target rate. One must remember that despite their legal mandate, their primary assignment is to maintain economic stability by supporting and preventing another “too big to fail” scenario for the major US banks like 2008-2009.

Thus the consumer will be required to pay the price; no matter what.

When one takes consideration of just this product and applies the embedded price across a wide swath of consumer goods, despite an alleged reduction in the annualized rate of inflation, the truth is that actual deflation to return prices to pre-2019 levels is the only solution for the affordability issue.

But do not worry, the official rate of inflation will continue to decline; the government said so.

For those wondering, the quote at the top of this article is from the HBO miniseries Chernobyl.