In December of 2024, these pages posted an economic prediction bearing the number 12 the following:

When I wrote this, I predicted some level of economic and political instability but nothing, I repeat nothing like we have seen since February of this year was even remotely close to happening in this author’s wildest imagination.

Unfortunately however, the price action is not indicative of people discovering that the shiny rock is a really good hedge against inflation and fiat currencies. When the world starts seeing $100 per day plus moves in gold it’s more of a warning that something very ominous is on the horizon.

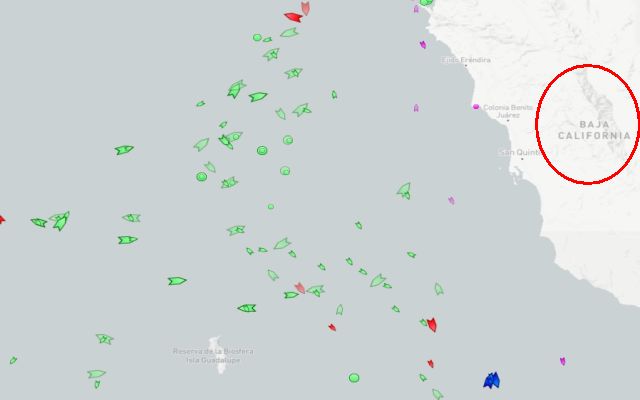

As the United States has used the US dollar and its trade hegemony as a weapon around the world, the realization that holding physical gold and other commodities is a great hedge against the sanctions weapon. Russia started planning for this long before the sanctions were levied against their nation at the start of the 2022 Russo-Ukraine War and now China has followed suit for the past several five years preparing for the inevitable economic confrontation with the West.

Unfortunately, many lost souls thought that the US central bank would act responsibly since the 2009 disaster, but that was a lost cause with each step towards the fiscal disaster in concert with Quantitative Easing to infinity. To add to traders and foreign government concerns is the apparent Nixonization of the US economy and trade concept as discussed in these pages last night.

The performance of precious metals as an asset this year far exceeds anyone’s wildest imagination, which is terrifying when one starts to consider future outcomes.

While one can attempt to dissect or justify these moves, the breakout in the last 30 days is nothing short of warning for the remainder of this year. And perhaps, just perhaps, credit markets are finally confirming this signal with some very interesting action of its own.

Theoretically, SOFR should be trading much closer or below the 2 or even the 10 year yield, but something else appears to be lurking in the background of the credit plumbing.

Maybe the goldbugs actually do pay attention to credit and this could be a contributing factor to foreign central banks accelerating purchases and delivery of physical gold. Regardless, I would take these warnings seriously because when US Treasuries and precious metals are being used as hedges, something very wicked may well indeed be on the horizon.