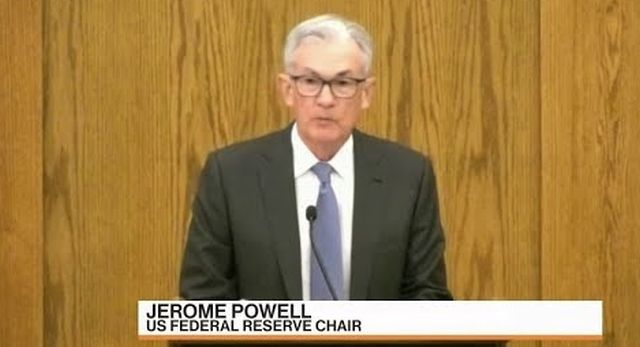

On Friday, Fed Chair Jay Powell gave a speech about inflation which sparked an equity market sell off but a yawn from the smart money.

Just who or what is considered “the smart money” is a question quite a few have asked about for many years. The truth is that bond traders, be it in the corporate arena or government instruments, are a better reflection of what large institutional investors think not just about inflation or the economy, but the actions of the Fed.

Their reaction on Friday was to call bullcrap on everything that Powell said.

The US 2 Year basically said “we don’t believe you” in its action:

After popping up to 3.43% the buyers returned knowing that at some point the Fed will have to keep buying US Treasuries, just like it did last week. The longer term chart reflects at a minimum where the Fed will have to allow the two year yield to move, and to be honest, I just do not see this group of political whores at the Fed to allow that to happen:

The chart above is from the 1999 .com hysteria, through 9/11, the Internet bubble crash, the Great Financial Crisis, the 2018 Christmas scare, and then the fauxdemic. Notice at no point in time has the 2 year yield soared back above 5% in the last fifteen years. That is the target people should watch out for.

The same could be said for the US 10 Year Treasury:

Honey Badger Bond Buyers did not care and did not believe him.

The long, long term chart reflects the indifference also:

IF, and that is a huge “IF”, the 10 year yield ever closes above 6% I might pay attention. Until then, I agree with the smart money, the Fed is simply playing politics and lip service.

The corporate high yield market is starting to move, but still has a long way to go to convince yours truly also, as reflected by the HYG ETF:

Low volume, no conviction, and a long way to the Christmas Crisis of 2018 levels around 67. Break that with high volume and once again, I might pay attention.

The currency markets also dismissed this as a non-event as illustrated by the lack of action in the common DXY:

Unless the recent highs are violated with volume (conviction) and a run at the historic 120 level occurs, this is just another feint by the Fed which is scared of its own shadow.

Why did the smart money dismiss Powell’s “stern” speech with such ambivalence?

This one phrase from his speech (via the Federal Reserve website) might provide a clue as to why:

The second lesson is that the public’s expectations about future inflation can play an important role in setting the path of inflation over time. Today, by many measures, longer-term inflation expectations appear to remain well anchored. That is broadly true of surveys of households, businesses, and forecasters, and of market-based measures as well. But that is not grounds for complacency, with inflation having run well above our goal for some time.

The Federal Reserve continues to live in a 1980’s mentality where reality is not grounded in their own monetary mistakes in concert with a level of fiscal irresponsibility by the uniparty which has doomed future generations in America.

The “expectations” he refers to are from a public who thinks housing is just another speculative Air BnB meme stock, that AMC is a viable business, that Bitcoin or Dogecoin would replace the dollar, and my favorite idiocy due to recency bias, “the Fed would never allow another crash” or words to that effect. The American public, especially large corporations, could care less about anything but their own profitability. The reason the public’s expectations are ingrained with this belief as part of American society is because since 2009, every error made by business or the masses has had some degree of a bailout, be it from the Fed or the Federal and/or state governments.

The Federal Reserve was not created to “protect” the consumer or the economy; it was created to preserve those member banks so they can engage in financial and social engineering for profit. Nothing more, nothing less. If the Fed wants inflation, they create it by excessive monetary expansion and allowing for speculative excess.

When it is time to real harvest of the suckers, they will do so and create an economic depression to clear out the insanity of the prior era while expanding the assets of their member banks.

Unfortunately for the Fed, this time history is not on their side. The unipolar world is dissolving and in the end the dominance of the Fed and the US dollar might be coming to an end. In that world, a stagflationary depression is probably in the cards, where the survivors will be forced by the government to socialize losses to prevent a collapse of this version of civilization.

This explains why the smart money stayed on their yachts, did not sell their bonds, nor break a sweat beyond missing a putt on the back nine. Nobody believes Powell or the members of this Fed. Unless the Fed comes out and actually sells 30 year bonds it holds along with short term notes in September, concurrently with the $90 billion QT runoff, to the tune of at least $20 billion, preferably $40 billion, there is no reason for the bond market or anyone else to take this clown show seriously.

The Fed and Jay Powell has built the perfect trap for the institution by destroying its own credibility. Barring a rapid contraction in the liquidity they provide, the speculative and fiscal insanity will continue unabated, especially heading into the midterm election.

The smart money told me so.